The operating cash flow is the amount of cash generated by a business, for a specific period, through its normal operating activities within a particular period. Related: What Are Business Activities in Accounting? (With Examples) Operating cash flow formula Meet the business' needs for financing activities, including interest and debt payments, paying dividends or repurchasing shares from stakeholders

Have sufficient capital for future business growth through investment activities The operating cash flow shows whether the core business activities produce sufficient cash flow for the business to: A negative OCF means that the company needs to borrow money or raise additional capital to continue meeting its financial obligations.įinancial analysts, investsors and lenders look at a company’s OCF to determine the overall health and profitability of a business. Also, the metrics for OCF should trend upward, indicating an increase in profitability.Ī business needs a positive operating cash flow to remain solvent in the long term. Generally, a company should aim for a higher OCF, which means it can increase capital without the need for investments or funding. Operating cash flow represents a company’s overall ability to turn a profit.

Operating cash flow meaning free#

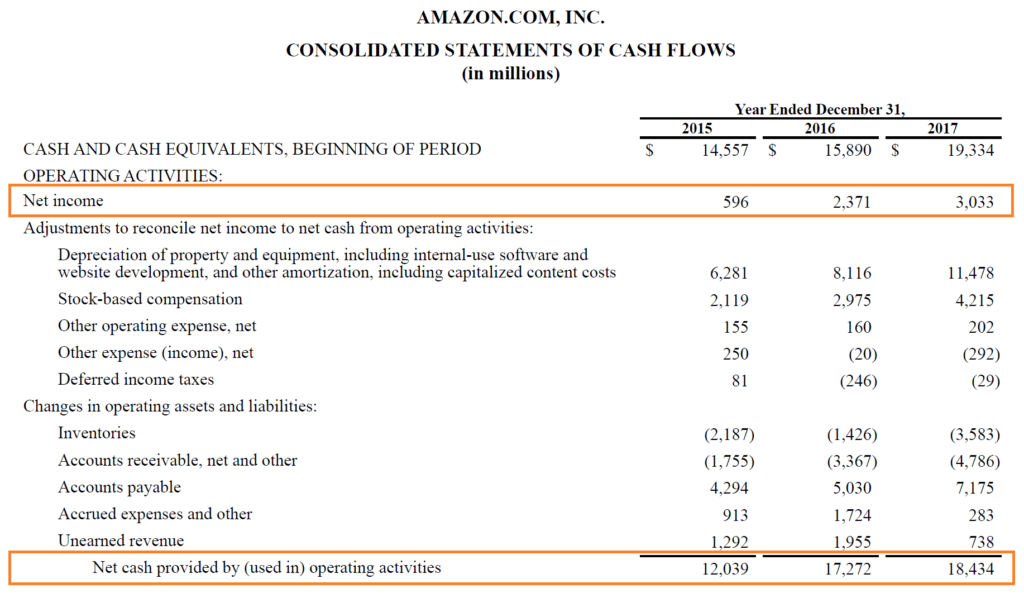

Operating cash flow is also known as cash flow provided by operations, cash flow from operating activities and free cash flow from operations. The calculation of OCF excludes financing and investment activities, such as borrowing, buying capital equipment and making dividend payments. It includes cash inflows and outflows related to a company’s main business activities, including selling and purchasing inventory, providing services and paying salaries. Operating cash flow represents the cash a company generates from normal business operations.

0 kommentar(er)

0 kommentar(er)